Active Portfolio Management Using Machine Learning: The Next Financial Frontier.

The revolutionary power of computers first appeared on the portfolio management scene nearly 40 years ago, with the first-ever index fund. Launched in 1975 with just $11 million in assets, it’s now called the Vanguard 500 Index Fund and is worth more than $690 billion today.

A few years later, statistical arbitrage – a trading strategy based on quantitative data mining, statistics, and automation – came around. A few years after that, high-frequency trading – an algorithm-based method, made famous in the Michael Lewis book Flash Boys, that can execute thousands of trades per second – was introduced. According to researchers, bots now perform nearly three-quarters of all stock trades in the U.S.

Artificial intelligence-based machine learning (ML) models are the latest technological innovation to hit the portfolio management industry. And while, at least so far, ML models have not been a panacea for active investment managers, they’ve proven themselves a valuable tool by augmenting human decision-making around important activities such as asset allocation, risk management, and portfolio construction.

But before diving into the details of how ML helps active portfolio managers improve investment returns for their clients, it’s worth looking at just what portfolio management is in the first place.

What is portfolio management?

Portfolio management is the practice of choosing and managing various investments, with the twin goals of maximizing returns while minimizing risk, for an entity (be it an institution, a company, or an individual investor). While some prefer to manage their own investments – especially in the era of trading apps and retail market manias – it’s very common for portfolio managers to oversee an entity’s portfolio of assets. Generally, there are two types of portfolio management:

- Passive management: Also known as index investing, his management style typically involves index funds or exchange-traded funds (ETFs) and is more or less a “set and forget” type of investing.

- Active management: As the name suggests, this involves a portfolio manager actively buying and selling equities in an attempt to find alpha, an industry euphemism for outperforming the market.

Although passive management has risen in popularity recently thanks to robo-advisers and passively managed ETFs, active management provides more highly personalized portfolios and support. Types of active portfolio management include discretionary portfolio management (where investment managers have full control over trades and trading strategy) or non-discretionary management (where managers provide advice and the client ultimately decides).

The goals of both portfolio management styles are the same: Choosing the best investment strategy based on a range of factors, including income, time horizon, and risk appetite. This involves the optimal allocation of investment funds, maximization of return on investment (ROI), and optimization of risk factors, taking into account financial measurements such as the Sharpe or reward-to-variability ratio.

The optimization problem

The practice of portfolio management is essentially an optimization problem: Identifying the most effective solution out of all possible solutions. In the specific case of portfolio management, that optimization problem boils down to maximizing returns while minimizing risk.

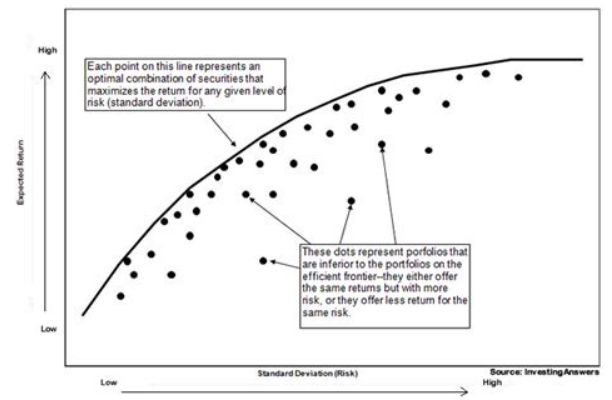

Much research has already explored how to achieve the best portfolio-based decision-making. It began with Harry Markowitz’s modern portfolio theory (MPT) in 1952. A cornerstone of MPT is the Markowitz Efficient Frontier, a tool for visualizing the optimal portfolio.

Image courtesy: https://investinganswers.com/dictionary/h/harry-markowitz

As the image above shows, the Efficient Frontier classifies portfolios’ effectiveness based on the return rate on the y-axis and risk on the x-axis (assuming all investors want to reduce risk and maximize ROI).

“A key finding of the concept was the benefit of diversification resulting from the curvature of the efficient frontier,” according to Investopedia. “The curvature is integral in revealing how diversification improves the portfolio’s risk/reward profile. It also reveals that there is a diminishing marginal return to risk. The relationship is not linear. In other words, adding more risk to a portfolio does not gain an equal amount of return.”

How data and technology (including machine learning) are changing active portfolio management

The mathematical nature of portfolio management naturally lends itself to solutions and improvements using data and technology. Experts believe active investment managers using quantitative data science techniques, including ML, will most likely be able to find alpha in more cost-effective ways. It will also allow them to compete more effectively with passive strategies, which are less expensive.

The unstructured data problem

As is the case in many other disciplines, the amount of data now available to portfolio managers is too large for manual collation and analysis techniques to handle effectively. Adding to the problem, unstructured data – which does not work with traditional analysis techniques – such as internal reporting, correspondence, and even social media data are by far the most common type of information.

Fortunately, AI and ML techniques, including natural language processing (NLP), can make sense of all that unstructured data on a scale never before imagined. NLP and ML models can read unstructured data and turn it into structured data using named entity recognition (NER), for example. ML models can even analyze unstructured data such as sounds or images.

While a “bag of words” approach has been the most common in the past, researchers are now using deep learning techniques and neural networks to create unique dictionaries of risk-prone words and phrases. This is vital for accurately training ML models and has created more opportunities for managers to deploy ML in real-world situations.

Some investors have also adopted a so-called “quantamental” investing approach, involving a mix of quantitative and fundamental research.

The rise of the machines in active portfolio management

Some in the industry say the adoption of ML in the portfolio management space will blunt the growing popularity of passive portfolio management, partially because the raw speed of ML is so aptly suited to the investment industry. Research says, for example, that ML techniques are around 10 percent more successful at predicting bond defaults than prior models.

According to MIT’s Robert Pozen and Jonathan Ruane, while ML cannot replace human judgment, it does provide the following benefits for active portfolio managers:

- Pattern detection: ML models can sift through mountains of structured or unstructured data to discover patterns and identify equity targets. “For example, ML can sift through the substance and style of all the responses of CEOs in quarterly earnings calls of the S&P 500 companies during the past 20 years to spot patterns and gain insights,” according to Pozen and Ruane.

- Use of unstructured data: As mentioned above, ML models can use and understand data from sources once thought negligible at best as far as big data analysis goes. “For example, by examining millions of satellite photographs in almost real-time, ML algorithms can predict Chinese agricultural crop yields while still in the fields or the number of cars in the parking lots of U.S. malls on holiday weekends,” Pozen and Ruane say.

- Reduction of bias: While it’s true that even ML models can themselves be biased depending on how they’re built and trained, this bias pales in comparison with some of the irrational decision-making that takes place in the markets (including loss aversion and confirmation bias). “ML can be employed to interrogate the historical trading record of portfolio managers and analyst teams to search for patterns manifesting these biases,” writes Pozen and Ruane.

Types of ML techniques used in active portfolio management

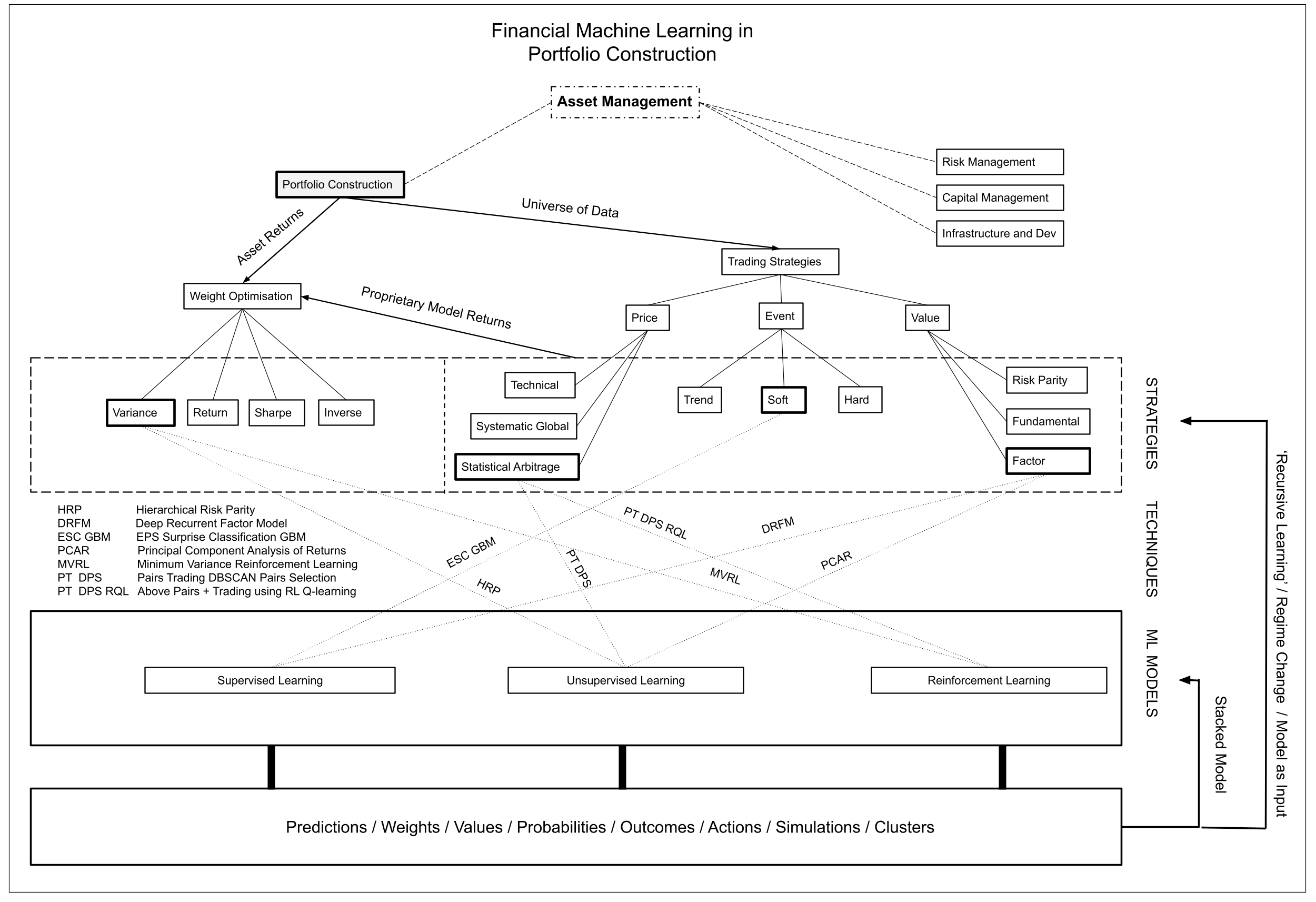

According to Derek Snow of the Oxford-Man Institute of Quantitative Finance, financial machine learning can be divided into four different streams: 1) Asset price prediction; 2) Event prediction (such as mergers and acquisitions or other major business news); 3) Value estimation of items such as future revenue or valuation; and 4) more traditional optimization activities such as portfolio construction/optimization and tactical trading decisions on timing and position size.

Image courtesy: FirmAI on Medium

Portfolio managers can use ML models in isolation or combine them with other models or neural networks to improve effectiveness, an approach known as model stacking.

ML models can help portfolio managers with trade execution, idea generation, alpha factor design, asset allocation, position sizing, and strategy testing. Snow outlines two ML approaches often used specifically for portfolio construction: Reinforcement learning (RL) and supervised learning (SL).

Reinforcement learning vs. supervised learning

Because RL is a type of ML that provides a cumulative reward to the ML agent based on its actions, it can benefit portfolio managers. RL models work under a predefined policy and must take actions within their environment. Indeed, according to Snow, RL is almost tailor-made for stock trading.

“Compared to supervised learning which answers the question, ‘will the asset increase in price tomorrow?’; reinforcement learning answers the question, ‘should I buy the asset today?’” says Snow. “The reinforcement learning algorithm is therefore already packaged as a trading strategy.”

However, RL still isn’t widely popular among portfolio managers because the technique requires large amounts of data (more than SL) and takes longer to train, can be expensive to test, and is very computing-power intensive.

Instead of observing and learning from its environment, like in RL, SL involves using labeled or annotated datasets to train algorithms to predict outcomes – in the case of portfolio management, often future share prices – or classify data based on inputs fed to the ML model. Types of supervised learning include linear regression and classification.

While SL is more established and commonly used than RL for reasons we listed above, some experts predict a gradual merging of the two approaches for portfolio management. “I simultaneously expect to see a lot of improvement on the RL trading front, so that RL adopts the advantages of SL trading methods while not forgoing its own strengths,” says Snow. “Conceptually RL offers a kind of paradigm shift where we are not overly focused on predictive power, which is an auxiliary task, but rather the optimization of actions which is and has always been the primary goal.”

Implementing portfolio management using ML? CapeStart can help

CapeStart’s ML and data science services and pre-annotated datasets for finance can augment expert active portfolio managers’ decision-making, improving risk exposure and overall portfolio performance for their clients. CapeStart’s ML models and training datasets can help mitigate risk, analyze credit scores, improve portfolio construction and sell-side trade execution, and even manage diversification and position size allocations.

For more information about what CapeStart’s machine learning experts and data scientists can do for you and your clients, give us a shout or start a free trial today.